An unexpected real estate advertisement appeared in my inbox the other day. It promised an amazing opportunity and attached some attractive sales brochure type information. I decided to take a look, because clearly anyone willing to prepare this material surely would have an interesting proposal for me to review.

In order to protect the names of the innocent (and guilty), I wont bother to post the entire document, but I will include a tidbit of some of the most egregiously horrible misinformation.

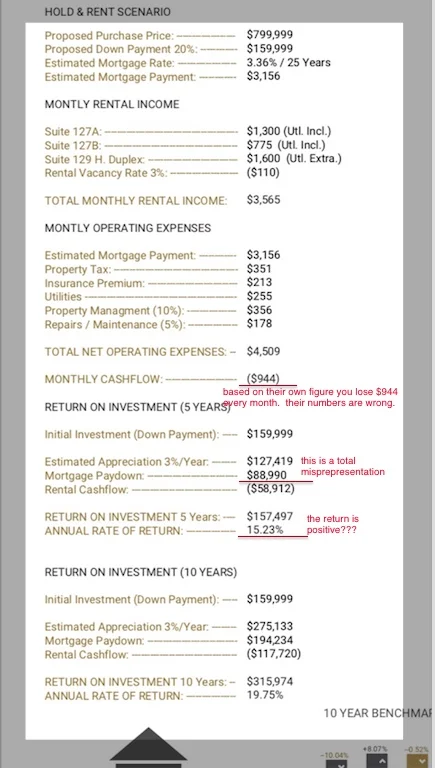

So to start, the amazing real estate opportunity to own your own rental property, as calculated by the sellers own (incorrect) figures, loses $944 each month (when it is rented and the tenants pay according to the lease). So at best, the owner would have to dig deep into her pocket and come up with the $944 each month to pay the mortgage. This sounds like a negative return doesn't it? No, after five years, the ROI is indicated at almost 15%!! That is good. Time to call your favourite realtor and write up an asking price offer!

Once you dig a little deeper, you will find that the math here is just terribly inaccurate. In fact it is so full of errors that you have to assume it is purposeful. Could anyone really be that wrong though? Could a realtor who is a professional in dealing with property as his full time career be so off on his numbers?

I will list a few real numbers below to show how I can irrefutably show the rental pro forma presented is just awful.

1. The downpayment cost is not calculated. The buyer needs $160k down to buy this deal. If that money was invested in a conservative 5% yielding investment, it would earn $666 per month.

2. The monthly loss based on rent vs expense, if this is even accurate, is already -$944. Once you lose the further $666 which is income you give up from the downpayment, that loss broadens now to $1610.

3. But this deal has a 15% five year return, how can that be when it loses $1610 each month? The supposed return is based on assumption of future appreciation and mortgage pay down, but this is calculated wrong as well.

4. The realtor suggest the property will be worth about $927k in five years, plus the mortgage will be $88k lower, so the return, after losing $59k over those same years still pencils out as positive $157k. I will show how wrong this is below:

- There actually is no mortgage pay down. The mortgage is just dropping because the owner is paying it herself from the negative cashflow of -$1610 x 60 payments = $96k. So the mortgage is $88k lower, but that cost $96k. That means the owner paid $96k to payoff $88k in debt, that sounds pretty bad to me (the difference is interest to the lender). Paying down your own debt is not profit. That would be like moving a dollar from your left pocket to your right pocket, and claiming it as profit.

- The appreciation is not assured - the property is already so over priced based on its rent to income ratio that is seems unlikely that further $127k of appreciation could occur. To realize this, the 2018 buyer would have to find a new buyer in five years that would view the property as even more valuable, despite the economics being even worse at that highly appreciated valuation. To even get to that five year resale horizon, the buyer would need to come up with $96k to feed the loan.

- Sales costs are not factored into the return - in five years, the sale commission would be significant and would wipe out a lot of the appreciation (which may not have even happened).

This property is a hideous black hole of an investment that could really hurt the buyer. I would urge no fledgling real estate investor to even consider the deal at the numbers shown. The realtor involved seems to know a little about real estate, but just enough to make him dangerous. If you are going to work with a realtor, take their advice, or accept their numbers as factual, you need to be extra careful and assume each number provided to be incorrect.

It is really troubling that this real estate profession is so often plagued by these borderline deceitful quasi professional looking information sheets. If this was a different type of investment brokerage, these documents would not be acceptable. Yet somehow, for what could be an individuals largest purchase of his or her life, the realtor somehow can become a trusted advisor, yet offer advice that is simply garbage.

There are ways for a person to educate themselves on rental property. I'd recommend the www.biggerpockets.com website. While it is US based, it has some great calculators to take a lot of the mistakes out of rent/buy decisions.

Take a look at the numbers here, this awful deal is presented as a winner. It is as far from a winner as I have witnessed.