The new council is on board and apparently blindly bungling its way into the townhouse game without any of the prerequisite expertise to consider the second order consequences of its actions. Rather than ‘fix’ the challenges of working in infill areas it seems to demand a complete ‘do over’ and wants to ‘get it right’ this time. Of course, this may sound good, but the actual motions put forth toward what the new zoning bylaw would be like are revealing. Here are some of the top horrible suggestions from council.

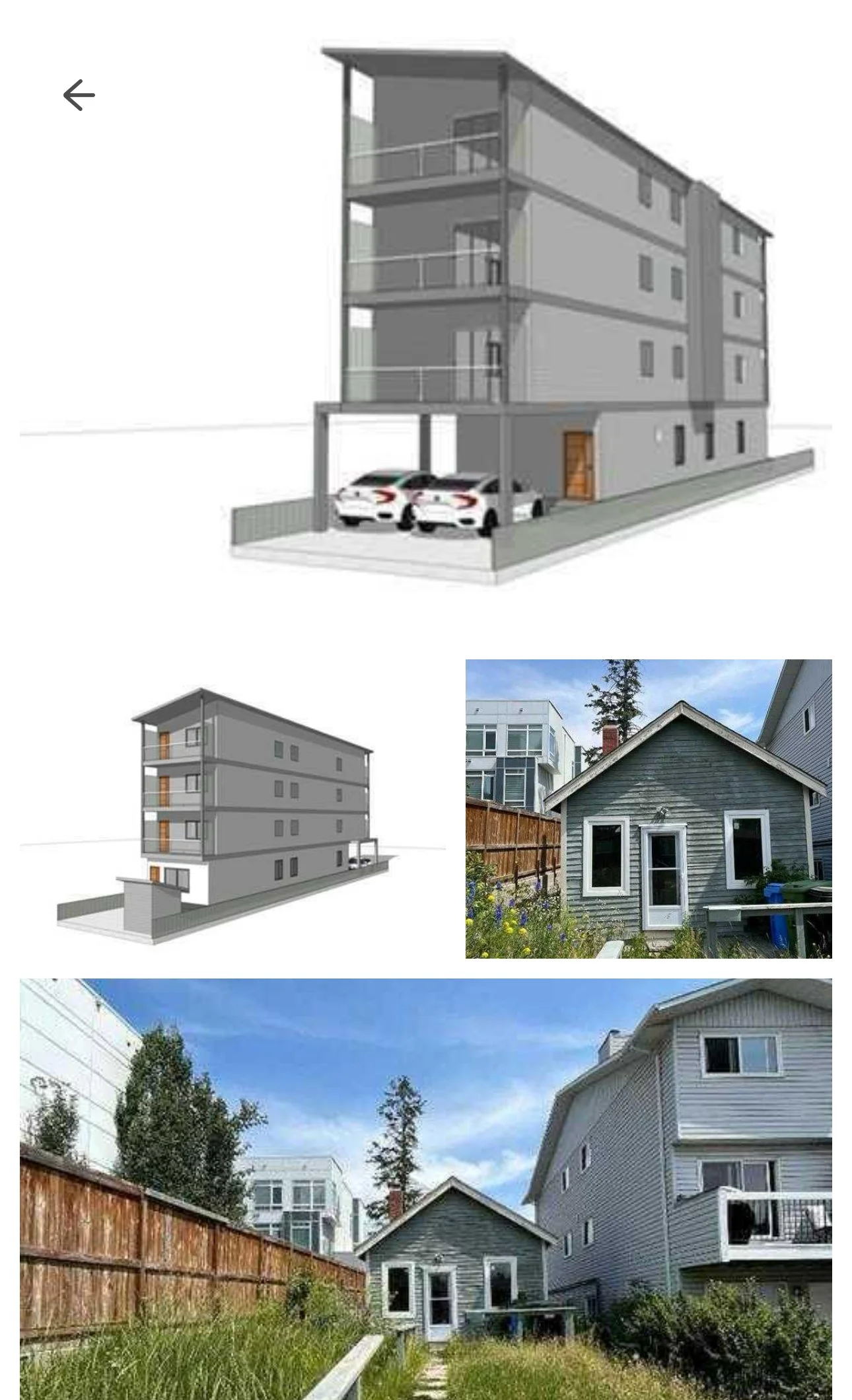

55% site coverage - this drops the buildable area from 60% to 55%, thus is extremely detrimental to the all important floorpan of the townhouse. Imagine squeezing a 700 square foot main floor to 640 square ft without loss of functionality and space.

60 units per hectare from 75 units per hectare - this change is directly in conflict with the most common 6000 square foot lot size, and would reduce the number of townhouses from four to three. Of course, given that three is an uneconomic number, due to all the added compliance costs nullifying the value of an entire townhouse, there is no point in even considering building a Threeplex.

more front setbacks - another terrible impact to essentially ruin projects by pushing the building so far back in the lot it makes it impossible to have a sizeable enough footprint to build upon.

stricter height limits - force the townhouse both deeper into the ground and with a lower roof peak, to materially harm the viability of the project. this appears to be the desire among this council, to impact the business case such that no townhouse can be built.

So there you have it, in a city on its way to 2 million, to regress infill rules back to what would have been expected 30 years ago in a city one third this size. Council couldn’t even agree a 600 m zone around new train stations to allow easy townhouse permitting. The same council will be tossing 5-10 billion dollars at new transit, only to not have coherent land use policy adjacent to it. The dearth of ideas was just so profound among this group, it is more reminiscent of what you’d see in nearby British Columbia, to restrict development so heavily in policy and rules that it paves the way for single luxury product to be fast tracked and de-risked at all points of contact within permitting. All investment dollars would then be focused on single home building, at the expense of most other building forms. And this is being done in the name of ‘affordable housing’. The outcome here would be the elimination of the townhouse with suites rental business, which is creating most of the actual ‘affordable units’. The entry level infill product would be a semi detached home with a price plus or minus of $1 million, and a single detached would start at $1.5 million.

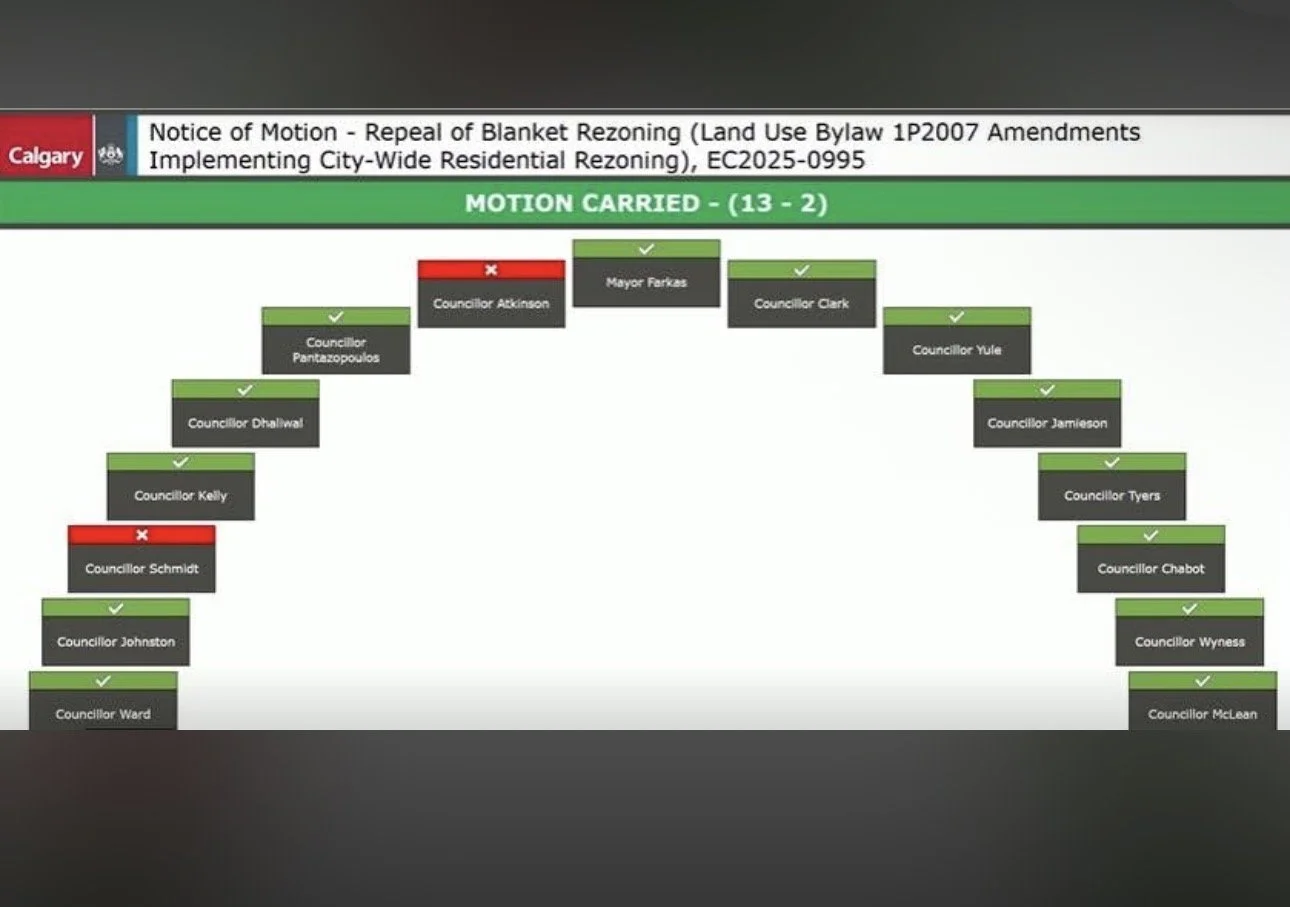

The notice of motion to call a public hearing to revert back to the obsolete 2007 bylaw regulating townhouse development.